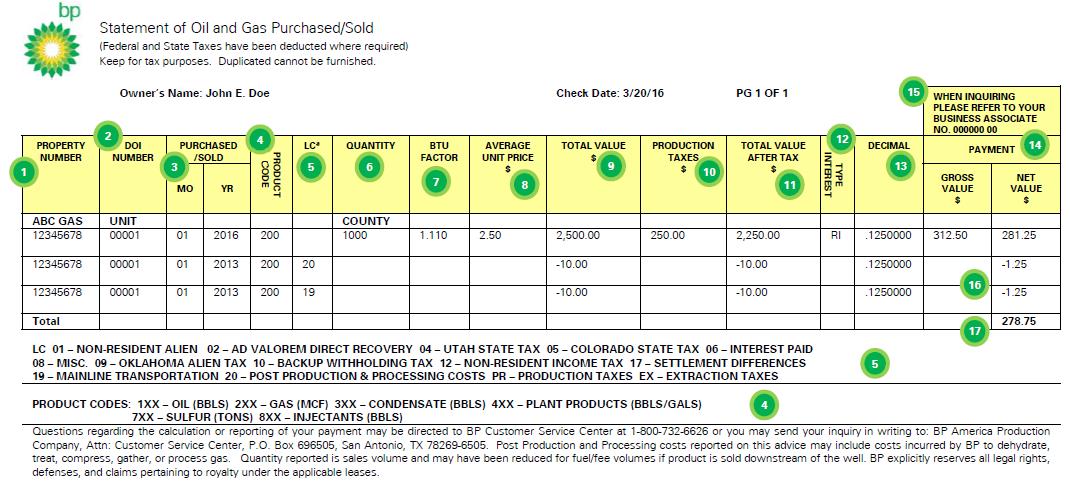

Check Stub Sample

Oildex:

Oildex provides revenue check detail at www.oildex.com

How to access and login to Oildex

- Property Number – The eight-digit number assigned to the lease or unit. The property name, county and state appear on the line directly above the first occurrence of each Property Number.

- DOI Number (Division of Interest Number) – The five-digit number assigned to further define the property for accounting purposes.

- Purchased/Sold – The month and year of individual sales or purchases which are included in the payment.

- Product Code – A three-digit code specifying the product accounted for on this line. The Product Codes most often used appear at the bottom of the payment attachment. "X" denotes a number that further identifies a specific product.

- LC (Legend Code) – A code identifying deductions or special payments. An explanation of the codes most often used appears at the bottom of the payment attachment.

- Quantity – Gross volume of a transaction shown in barrels, gallons or MCF (thousand cubic feet)

- BTU Factor (British Theram Unit) – The heating value of the gas.

- Average Unit Price – Calculated by dividing “total value” by “quantity” for each line. (Unit price may be omitted on certain adjustments, if not informative).

- Total Value – The before tax value of the quantity for each property – DOI.

- Production Taxes – Severance and other production taxes applicable to the oil or gas sold from each property – DOI.

- Total Value after Tax – Net value after production taxes are withheld.

- Type Interest – A two-character field designating the type of interest accounted for on each property – DOI.

Possible Types of Interest

- BL – Blanchard Royalty

- CR – Compensatory Royalty

- MI – Mineral Interest

- OC – Override Convertible

- OR – Overriding Royalty

- OU – Override Unsigned

- OW – Override Working Interest

- PP – Production Payment

- PR – Partnership

- RI – Royalty Interest

- RO – Reversionary Interest

- RU – Royalty Unsigned

- WI – Working Interest

- WR – Working Other

- Decimal – A decimal used to reflect your proportionate share in the sale of production from a property. Note, the Disbursement Decimal shown can differ from the DOI Decimal. For example, if there are multiple working interest owners in a property, the Disbursement Decimal may be adjusted to reflect your proportionate share of the volumes your lessee is entitled to receive.

- Payment – "Gross Value" is your decimal interest applied to "Total Value" before deductions or special payments. "Net Value" is the gross value less your share of taxes.

- Business Associate Number – The number assigned exclusively to you as an owner will be printed in this space. The number shown is only an example.

- Deductions – A dash or minus sign ("–") before any amount in the "Payment" columns indicates a deduction.

- Total – The total amount of the payment.